Scaling Transition Finance

Scaling Transition Finance: Findings of the Transition Finance Market Review

The Transition Finance Market Review (TFMR) has published its final recommendations, offering a roadmap to scale a high-integrity transition finance market that supports UK and global decarbonisation goals.

Transition finance is essential if we are to deliver on decarbonisation commitments and achieve the goals of the Paris Agreement. ‘Scaling Transition Finance: findings of the Transition Finance Market Review' sets out recommendations on how to scale a high-integrity transition finance market that can support both UK and global net zero ambitions.

Facilitating and delivering this investment from public and private sources, in the most impactful and efficient way, will be critical. If done correctly, this will present significant opportunities to the companies and investors that find themselves on the front foot.

Central to the findings of the Review are recommendations on how to unlock the required levels of finance by creating the right policies, pathways, and signals for investment through collaboration between government, investors, business, and civil society.

This landmark Review is co-sponsored by HM Treasury and Department for Energy Security and Net Zero, and hosted by the City of London Corporation. Download the report now to see the full set of recommendations to policymakers, financial institutions and professional service firms, companies and civil society.

- US $200tn of transition finance needed to deliver on commitments and meet Paris Agreement climate goals

- US $6.7tn per year of annual investments in transition finance needed to meet global decarbonisation goals

- £2.7tn of investment needed in the UK between 2021 and 2035 to meet net-zero commitments

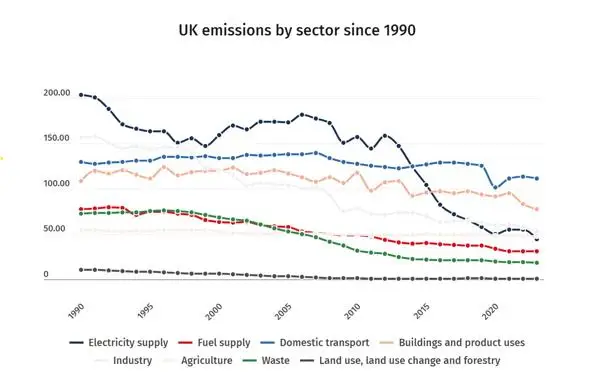

The UK will require an estimated £50-60 billion annually through the late 2020s and 2030s to meet its net zero objectives. While progress has been made through decarbonising the power sector, further investment is crucial in sectors like industry, transport, and agriculture.

"Transition finance is key to unlocking decarbonisation across the global economy including in sectors where immediate transformation is complex. It offers opportunities for countries and organisations, but there is a material risk to not acting now. This Review comes at a critical moment, as industries and investors alike recognise the need for transparent and credible financing solutions that drive meaningful climate action."

Vanessa Havard-Williams, Chair of the Transition Finance Market Review